A new purpose-built national wrap network could minimize cost, simplify the claims process, and make out-of-network care less painful for employer-funded health plans.

The need to strike a balance between provider access and cost of care is perhaps most profound in an employer’s wrap network.

Introduction

According to a national survey, employers recognize that their health benefits plans are playing a more pronounced role in attracting and retaining employees, especially since the pandemic. Two-thirds of employers consider health benefits as vitally important in their management of talent. But while employers are seeking to expand their health benefits offerings—a broader provider network being one of the most important factors—they are highly concerned about managing the cost of care. The latter point is particularly significant as most employers (60%) have seen their healthcare costs outpace inflation over the past three years and expect that trend to continue.¹

While many health plan provider networks are comprehensive, plan members still venture beyond the reach of their primary network. Whether they are traveling or close to home, employees and their dependents sometimes choose to engage providers that are not within their plan’s established network. That’s when a wrap network comes in.

Wrap networks are designed to enable access to care when plan members do opt to seek care from a specialist that is not in the health plan’s primary network. The challenge for employers is that with little or no provider fee boundaries nor sufficient pricing transparency, out-of-network care is often financially distressing to health plans and the employees and families they serve. While employers are willing to give their health plan members the choice to seek care out of network, there is also a need to establish greater cost control for that care. Unfortunately, HR decision makers tend to have little familiarity with and understanding of wrap networks.

The employers who are familiar tend to be satisfied with the breadth and quality of their wrap network but are often extremely dissatisfied with the associated expenditure. These employers consider the most important attributes of a viable wrap network solution to be controlling the cost of access to providers, pricing transparency, and cost savings greater than currently available options.

“The intent is to be able to bring more transparent network products to the market—especially in areas where transparency has been lacking, such as with out-of-network care. We are rethinking out-of-network wrap products to align them with what employers tell us they value most—cost savings and transparent pricing.”

Robin Bugni,

Contigo Health’s VP of Network Product & Development

Considering the lack of awareness and understanding of wrap networks and the level of dissatisfaction with the cost of out-of-network care, there is a significant opportunity for a better wrap network solution, one that delivers valued network breadth while also directly lowering medical claims costs through defined discounts and pricing transparency—in other words, building a wrap network that delivers on what matters most to employer-funded health plans. There is substantial employer interest in ConfigureNet™, a compelling wrap network model from Contigo Health® intended to address the access-versus-cost challenge by extending comprehensive coverage in all 50 U.S. states and across specialties while simultaneously introducing a level of cost savings through pre-negotiated provider pricing and a streamlined process that is direct to employers.

The high cost of out-of-network care

Out-of-network care has traditionally been more costly to a health plan and its members than in-network care. Out-of-network providers have had the freedom to charge higher rates since they are not bound by the health plan’s contracted primary provider network reimbursement. Out-of-network providers have no obligation to accept the reimbursement amount the health plan is willing to pay its in-network providers. This commonly leads to the practice of balance billing, where the provider charges the patient an amount above what the health plan paid and up to the provider’s originally billed amount. This can be an unpleasant surprise to health plan members and the health plan itself.

Beyond the provider reimbursement difference, the medical claims repricing progression often involves multiple intermediaries providing various services for which each can take its own administrative fee, adding more unexpected administrative cost to the health plan.

Contigo Health, LLC, as an architect of financially sustainable healthcare, has taken steps to identify a key area where a more contemporary model with real cost controls and pricing transparency could help employers address the care and cost imbalance of out-of-network care.

A survey about wrap networks

To gain a better understanding of current perceptions about wrap networks, and to reveal what gaps and opportunities there may be to improve those networks, a study was conducted by Stonegate in April of 2022.²

The survey focused primarily on input from health system employers—specifically HR decision makers and health system executives. This audience represents leadership in healthcare delivery, intimate knowledge of healthcare infrastructure and pricing, and perspective as one of the largest employers in a market. The findings complement broader industry studies regarding employer perceptions of care versus cost. The results revealed four distinct areas of interest for anyone desiring to create a better wrap network solution for their health plan.

How familiar are you with the word “wrap network”?*

*Sample size is 25.

Familiar (familiar) – 60%

Very Unfamiliar (somewhat to very) – 28%

Very Familiar (somewhat to very) – 12%

Nearly half (46%) of HR decision makers indicated they are neutral to extremely dissatisfied with the cost of their wrap network access.

Four things that employers should know about wrap networks

1. Health plan decision makers don’t tend to understand wrap networks.

An interesting discovery from the Stonegate study is that employers, by and large, do not appear to have a strong awareness of wrap networks, let alone an understanding of the costs associated with such networks. Among the HR decision makers surveyed:

- Nearly 1 in 3 (28%) are very unfamiliar with the term “wrap network.”

- Most (57%) admitted they don’t understand the costs associated with their current wrap network. Just 43% said that they definitely understand the costs.

This gap in understanding is an opportunity for a new wrap network solution that can deliver needed clarity, consistency, simplicity, and support. For those that do have an understanding of their wrap networks, the study revealed some valuable insight into what matters most to them, as is revealed in the next sections.

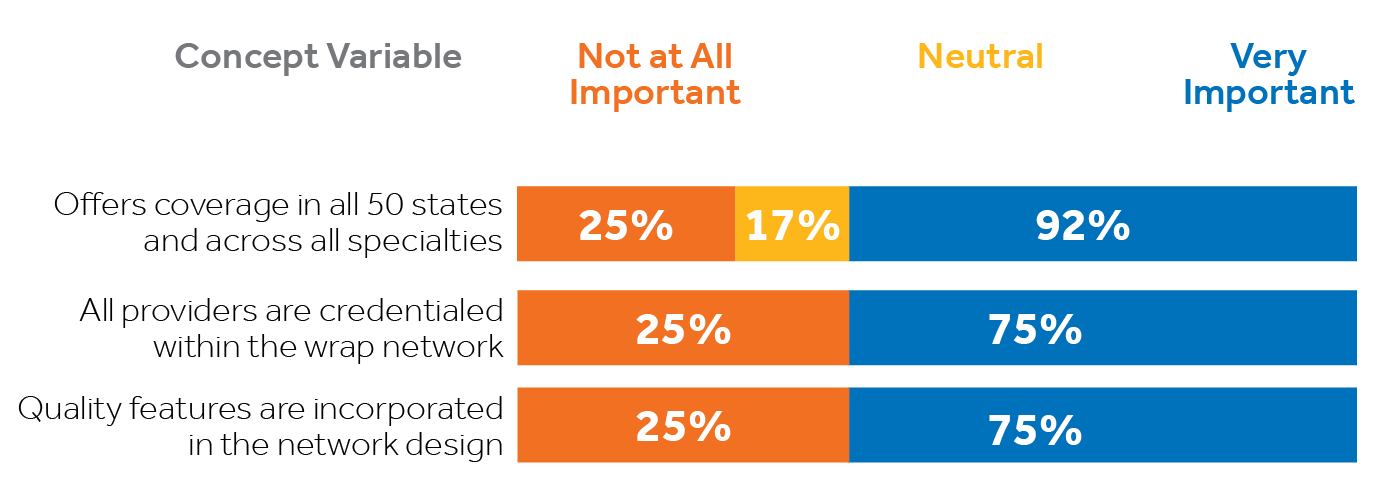

2. Breadth and quality get high marks. Cost, not so much.

The Stonegate-conducted study asked employers to identify the best and worst attributes of their current wrap network. The survey revealed that health plan decision makers are largely satisfied with their current wrap networks when it comes to the breadth and quality of network access.

- 85% are extremely satisfied with the extent of their wrap network

- 85% are extremely satisfied with the quality of network access

HR decision makers identified the following as the most important wrap network access and quality attributes.

Importance of access and quality attributes to HR decision makers

As encouraging as that is, employers are clearly less than satisfied and more concerned with the cost of that access. In fact, cost is the highest area of dissatisfaction among health system employers surveyed specific to wrap networks. Nearly half (46%) of HR decision makers indicated they are neutral to extremely dissatisfied with the cost of their wrap network access. That percentage may be conservative considering, in section 1, it was revealed that 57% of HR decision makers surveyed do not even understand the costs associated with their wrap networks.

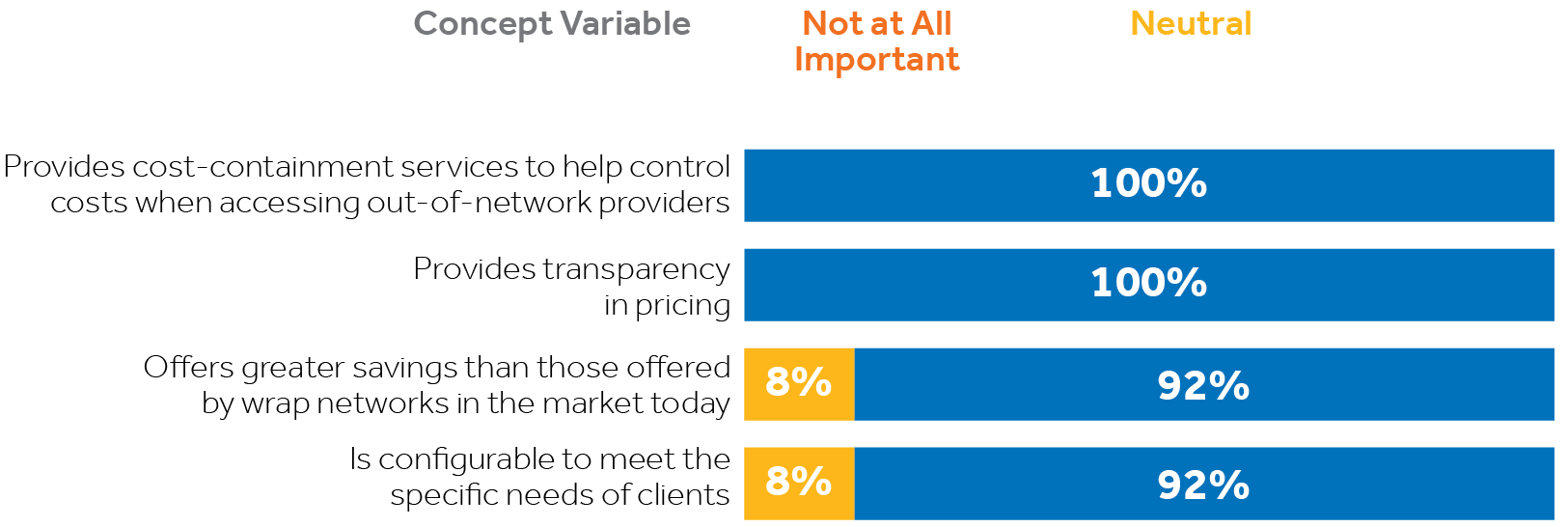

3. It comes down to economics.

The aspects of a wrap network that rose to the top among health plan decision makers surveyed by Stonegate consistently involved three areas: cost containment, pricing transparency, and cost savings. These are the characteristics identified as VERY IMPORTANT to employers:

- 100% indicated cost-containment when accessing out-of-network providers

- 100% emphasized pricing transparency

- 92% want more savings than what’s currently available

- 92% want a configurable wrap solution that meets their specific needs

Importance of economic wrap network attributes to HR decision makers

In consideration of the first three core study findings listed above, it is evident there is call for a more suitable wrap network solution for employers than is currently available. A better wrap network product would directly address employers’ cost concerns without compromising their plan’s access to care. The optimal solution would deliver on all the things that matter most to employers, including breadth and depth of their wrap network access, plus significant cost savings beyond the industry status quo, along with much-needed pricing transparency—in other words, securing the lowest possible price and eliminating unexpected charges without compromising access to care.

“Contigo Health’s charge is to be the architect of better, more sustainable healthcare. We are building the foundation for future network structures from the ground up by helping to reduce the cost of out-of-network care, should people need it.”

Steven Nelson, President,

Contigo Health

4. One solution is showing great promise.

There is significant interest among health system HR decision makers and executives in a new wrap network product pioneered by Contigo Health. Known as Contigo Health® ConfigureNet™, this contemporary wrap network product is structured to provide the coast-to-coast national coverage and key specialties that employers value highly. The wrap is differentiated in that it has been designed to introduce significantly discounted provider rates and a high level of pricing transparency, combining to enable a level of cost savings greater than what is currently available in the market. As the name suggests, ConfigureNet™ is also designed to eventually become configurable to meet the distinct needs of individual employers.

Developed specifically to meet the needs most emphasized by employers, ConfigureNet™ provides health plans with robust out-of-network provider access at a lower cost. The following features directly address those expressed needs:

Broad network coverage spanning all 50 U.S. states plus Puerto Rico

Pre-negotiated contracted discounts with 900,000 U.S. providers and 4.3 million U.S. locations

Better negotiated rates and greater savings

Contractual protection from surprise balance billing

Claims repriced promptly to contracted rate—no additional handling or unwarranted additional fees

ConfigureNet™ introduces nationwide access to contracted healthcare providers with pre-negotiated discounts in place for a full range of provider services including:

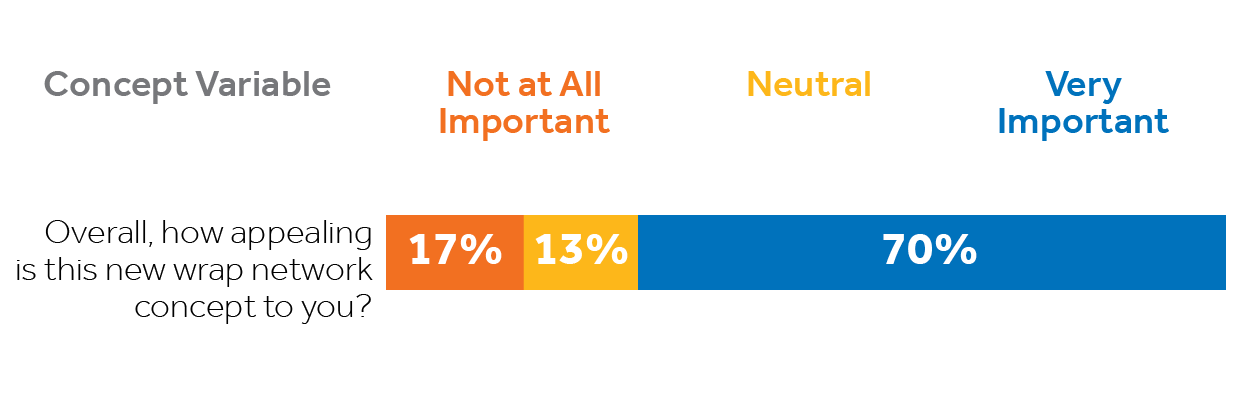

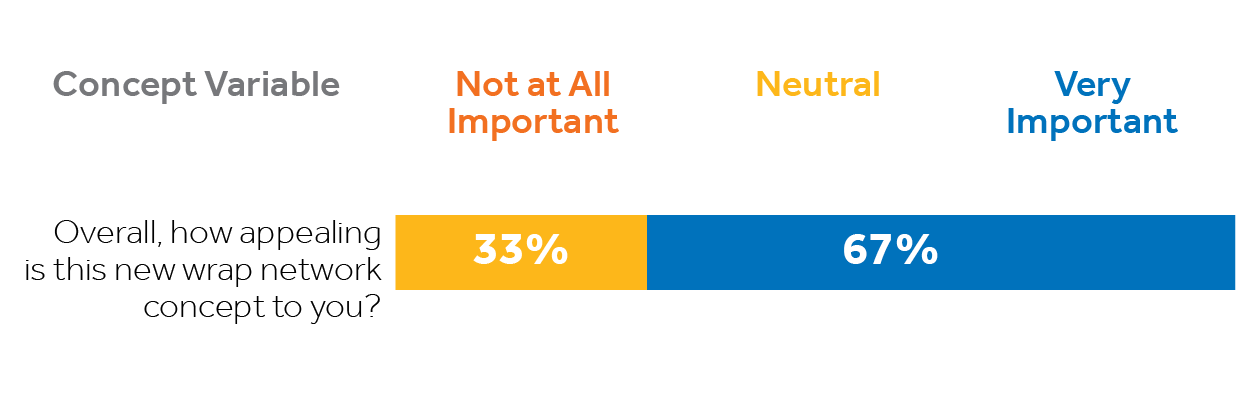

70% of executives and 67% of HR decision makers find the ConfigureNet™ wrap network concept very appealing.

A majority of Stonegate survey respondents find the ConfigureNet™ wrap network concept very appealing.

How executives view the ConfigureNet™ wrap network concept

How HR decision makers view the ConfigureNet™ wrap network concept

Contigo Health’s ConfigureNet™ out-of-network wrap solution has tremendous appeal because it addresses employers’ most pressing wrap network concerns while presenting features that matter most. Fifty percent of surveyed executives would definitely consider switching their wrap network if doing so would provide financial benefits to their organization. A third of HR decision makers and 30% of executives would consider carving out their wrap network from their current plan.

SUMMARY

Health benefits—including expanded out-of-network coverage—are increasingly important to employers as they place greater emphasis on attracting and retaining talent. Even so, they have serious concerns about managing the rising costs associated with those benefits, especially the high cost of out-of-network care.

Unfortunately, many employer-funded health plan decision makers and executives are either unaware of their wrap network or do not understand it. But compelling gaps in current wrap networks have been revealed in recent data, indicating there are attractive opportunities to provide employers with a better, more viable out-of-network solution that addresses the distinct attributes and performance characteristics decision makers have indicated are most important to them.

Employers who have a more thorough understanding of wrap networks appreciate the breadth of their current plans’ access to out-of-network care but, at the same time, are frustrated by the associated costs and lack of transparency. They would welcome a solution that substantially cuts their out-of-network costs without compromising valued access to care. Contigo Health’s new ConfigureNet™ wrap network appeals broadly because it is designed to give health plan decision makers more control of their wrap network. ConfigureNet™ preserves the merits of a broad and robust provider network (what employers like) while substantially controlling costs (what employers want). This is accomplished through contracts with 900,000 U.S. providers and more than four million locations coast-to-coast, and introduces pre-negotiated discounts, pricing transparency, and a streamlined process that can cut unwarranted additional fees. It can empower health plan administrators to impact their organization’s bottom lines while enhancing access and choice for their health plan members.

What solution will you bring to your health plan?

ConfigureNet™ has tremendous appeal to employers because it addresses their most significant wrap network concerns directly and delivers the attributes that matter most. Fifty percent of executives surveyed would “definitely consider switching” their wrap network if doing so would have financial benefits for their organization. That is why 37% of executives expressed they would be very interested in a no-cost consultation to compare the costs of ConfigureNet™ to their existing wrap network.

Leveraging its ConfigureNet™ nationwide provider network, Contigo Health has also created ConfigureNet™ Price Advantage, a flexible plug-in that gives employers a smart, “on-demand” repricing solution when and where it is needed most. It can be implemented as their dedicated

out-of-network cost-containment solution, or configured as a cost-saving option to expand the power of out-of-network cost containment solutions that may already be in place. Price Advantage was designed to be a no-risk, no obligation alternative.

See how Contigo Health can help you establish clear savings on your out-of-network wrap by conducting a complimentary out-of-network wrap cost analysis for each.

How it works:

1. You share health plan claims data

2. Contigo Health analyzes the health plan’s existing out-of-network claims data for the past year and identifies savings potential (two-week turnaround)

3. We meet to review and discuss savings opportunity and quote

4. Contigo Health creates a contract to make an easy and frictionless switch

For more information, contact Britt Hayes, Contigo Health’s Chief Commercial Officer at Britt.Hayes@contigohealth.com, or call 330-656-1072.

1. Aditya Gupta, Nikhil Mahajan, Carolina Malcher, Monica Qian, Matthew Scally, and Jeris Stueland, “Employers Look to Expand Health Benefits While Managing Medical Costs,” McKinsey & Company Employer Health Benefits Survey (May 25, 2022) source

2. ConfigureNetTM and Beckers, Health Plan Wrap Networks Perceptions survey (conducted by Stonegate), April 2022

© 2024. Contigo Health, LLC. All rights reserved.