By:

Steven Nelson

President, Contigo Health

Britt Hayes

Chief Commercial Officer, Contigo Health

The healthcare industry itself is not immune to the challenges of managing health benefits costs for its own workers. Benefit administrators for health systems are faced with the same challenge that all employers are addressing in 2023 and beyond: how to provide employees with the highest-quality care while optimizing costs and maximizing plan flexibility for both their healthcare employees and the organization. For U.S. companies, the cost of caring for more than one in two Americans receiving insurance through employer-sponsored plans continues to increase.¹

For larger employers, the total cost of health benefits further rose by 5.3% in 2021.² Even as they provide care to others, many health systems’ associates are seeing increases in their insurance premiums that are outpacing inflation and wage growth. In fact, the average annual health insurance premiums for family coverage for employer-sponsored health plans have topped $20,000 for the first time, according to KFF 2018. On average, covered workers contribute 18% of the premium for single coverage and 30% of the premium for family coverage. Total costs for these premiums increased by 22% from 2014 to 2019, and worker contributions increased by 25% during that time.³ To better manage the cost of care, employers across all sectors have transitioned to self-funding options. Today more than 61% of some 150 million people receiving employer-sponsored insurance (ESI) are covered by self-funded or partially self-funded healthcare plans.

In very large companies with 5,000 or more employees, 91% of workers are in self-funded plans, and the rate of adoption among smaller organizations continues to accelerate.⁴ Just like any other self-funded employer, health systems generally require some type of third-party administration (TPA) solution to administer their health plans. Some use carriers or health insurance companies that market “administrative services only” (ASO) options for their TPA functions. Others use traditional TPAs. A partnership with a specialty TPA that offers deep expertise in the intricacies of managing health benefits for healthcare workers, however, has the potential to be transformative across a health system’s entire organization.

For larger employers, the total cost of health benefits in 2021 is expected to further rise by 5.3%.

For the first time, average annual health insurance for employer-sponsored health plans have topped $20,000 per family.

Plan Management In a Complex Environment

Health systems must consider a myriad of business factors when evaluating a TPA relationship. In addition to the increasing costs of employee care, they are immersed in a volatile industry environment of skyrocketing patient care costs, tight operating margins, reimbursement pressures, complex partner relationships, and moves to new care-delivery models that require greater transparency. At the same time, they are also struggling to balance the benefits of new technologies with EMR and data management complexities, ever-changing regulatory issues, aging patient populations with more complex medical issues, and highly competitive workforce challenges. Adding to the current landscape is the impact of COVID-19.

Coupled with so many other issues, the pandemic has put even greater stress and uncertainty on the country’s healthcare system. These complications can make the prospect of transitioning to a TPA plan or a new TPA partner seem overwhelming for a health system. Yet the urgency to deliver quality care at lower costs, without compromising service and positive member experiences, is greater than ever before. Forging a relationship with the right TPA that has extensive expertise and flexibility can be an ideal solution for many health systems, despite the perceived complexities of making such a move. This is particularly true for larger health systems that have already invested heavily in quality health solutions for their employee population. They require a highly flexible plan that optimizes these investments, with options that fit specific needs of employees.

Specialty TPA Advantages for Differing Priorities

Simply put, self-funded organizations may choose a specialty TPA with deep health systems expertise to gain more control over their destiny than they could achieve in a traditional carrier relationship. That greater control can translate into flexible options in benefit design, data integration, population health tools (leveraging CINs and ACOs), and nondomestic network coverage, as well as substantial business reimbursement for patient care. It can also mean more significant opportunities to utilize their clinical strengths in caring for the organization’s employees. A specialized TPA relationship can address this need for control and customization, and it can respond to differing priorities across the system. From HR to finance to clinicians and business development, each function can realize positive impacts from an effective TPA partnership. Working with a TPA that is attuned to a health system’s entire ecosystem helps to create a personalized approach that empowers unprecedented collaboration.

A Tailored Approach

For the HR team at a health system, the TPA partner must be an expert in designing flexible plans targeted to the current and changing needs of the system’s workforce. It should have the capabilities to introduce new and innovative options for the health system’s most discerning population: its associates. The plan design must also integrate seamlessly with existing health management programs, such as PBMs, ACOs, and clinically integrated networks (CINs). The working relationship with the TPA partner is also a significant factor in helping to ensure the success of the plan. HR benefits administrators should expect high levels of service, responsiveness, objectivity, and useful reporting tools from the TPA.

Forging a relationship with the right TPA that has extensive expertise and flexibility can be an ideal solution for many health systems.

Working with a TPA that is attuned to a health system’s entire ecosystem helps to create a personalized approach that empowers unprecedented collaboration.

Domestic Utilization and Cost Management

For CFOs charged with cost and risk management across all aspects of the organization, a strong TPA relationship will help facilitate cost-containment opportunities. By focusing on actual costs rather than carrier rates, a well-designed plan can provide direct savings that remain within the health system. A TPA that possesses health system insights and expertise can identify opportunities for maximizing domestic utilization rates, which can contribute significantly to overall system revenue generation and employee benefits cost control. An experienced, employee-focused TPA will be able to lead a thorough analysis to assess gaps in quality of care and provider networks to strengthen domestic utilization. When health systems employees and their health plan dependents use the actual services they provide, they help contribute to building a stronger community and stronger brand while taking advantage of the quality of care provided by the health system.

Network providers can realize more financial benefits, and systems can play an active role in improving their staff’s health outcomes. By directly assessing and managing claims data while maintaining patient confidentiality or PHI integrity, health systems can find ways to mitigate rate increases over time. Utilization is vitally important in today’s healthcare environment. Increases in domestic utilization can make a difference when it comes to containing spiraling costs. From 2016 to 2017, spending rose 4.2%, while prices jumped 3.6%, but healthcare utilization only grew by 0.5% during that time, illustrating dramatic opportunities for improvement.⁵

Data-Driven, Patient-Centered Care

As CMOs, CQOs, and CIOs work with their systems to focus on strategies that deliver quality, data-driven, patient-centered care more effectively, a customized plan can make meaningful contributions toward these efforts. In an ideal scenario, health systems want to further improve their population health through a TPA relationship that can include tools to help tap real-time clinical information, enabling them to achieve optimal levels of appropriate care. Virtually every health system has invested heavily in data, technology, and EMR as mission-critical assets. U.S. health IT spending topped $7.1 billion in 2017 and continues to increase annually.⁶ Partnering with a TPA that has access to clinical data decision-support tools can help providers deliver a tailored plan to allow providers to offer the right care, at the right time, in the right setting, at the right costs. Leveraging these tools can help address targeted variations, thus enabling flatter overall medical trends.

A TPA with health system insights and expertise can identify opportunities for maximizing domestic utilization rates, which can contribute significantly to overall system revenue.

U.S. health IT spending topped $7.1 billion in 2017 and continues to increase annually.

Recruitment

A personalized plan can also serve as a powerful recruitment tool. HR teams must attract talent with a robust, affordable, and flexible health benefits package that enhances members’ experiences. Many employers are recognizing this need. The number of those who view their healthcare offerings as an integral part of their workforce strategy increased from 36% in 2019 to 45% in 2020.⁷ The right plan that includes work-life balance/flexibility programs, support for innovation, and mentoring opportunities can also be an essential retention tool for health systems employers in a highly competitive job market.⁸ According to a recent survey, more employees in the healthcare sector report they have been actively looking for a job during the past year than in other sectors.⁹

Business Development

Business development teams are seeking new revenue-generation opportunities. For some health systems, an optimized self-funded plan can help create direct relationships with non–health system employers looking for a better way to achieve their health benefit goals. The plan can serve as a model and a facilitator for initiating new relationships with employers in order to pursue broader strategic aims and increase market share.

Overcoming Barriers

A self-funded plan with a specialty TPA relationship can be a tremendous advantage for the right health system. But it is not always a solution for every organization. All potential barriers and objections should be assessed, along with timing, before considering a shift. For instance, the arrangement requires knowledgeable benefit administration skill sets to make the most of the TPA relationship. If the level of internal expertise is not currently present, the organization may need to invest in staffing to build or train the right teams. The same is valid for health systems that may be considering self-funding their health benefits plan as a precursor to delivering direct-to-employer offerings. Other barriers may include organizational concerns about disrupting long-standing relationships with current payors or moving from a large partner with a known brand to a nimble and specialized but lesser-known entity. In addition, an organization’s leadership may not recognize the potential value of a specialized TPA relationship without a thorough analysis of the positive impact it can have on the entire organization. HR teams should align with finance teams and be prepared to make the case. Changing the status quo in any organization is an educational process, and the transition to a new or different TPA relationship will require a thoughtful strategy. The goal should be to engage all stakeholders and address possible concerns while conveying the cost and operational benefits that can be realized. A specialty TPA partner with the requisite depth and breadth of health system experience can assist in helping to remove these barriers.

A personalized plan can also serve as a powerful recruitment tool.

For some health systems, an optimized self-funded plan can help create direct relationships with non-health system employers looking for a better way to achieve their health benefit goals.

HR teams should align with finance teams and be prepared to make the case.

Contigo Health: Uncomplicating the Complicated

Today’s healthcare world is more complex than ever before. Building a self-funded plan requires a TPA partner that will help “uncomplicate the complicated” while facilitating quality care, cost savings, and innovation. An experienced TPA partner understands the unique complexities of health systems and can effectively navigate self-funding design and implementation to realize the plan’s full potential across the entire organization. While numerous TPAs exist, health system decision-makers must closely examine the additional value a specialty TPA can offer. Contigo Health® Sync Health Plan TPA is redefining health systems’ expectations for TPA services with an exciting combination of offerings and continuous innovation. In addition to its legacy of TPA leadership, Contigo Health, formerly Health Design Plus (HDP), is backed by the strength and resources of its affiliation with Premier, Inc, a leader in data, analytics, consulting, and group purchasing for health systems.

Partnership Benefits

- Contigo Health offers leading-edge, TPA custom solutions designed expressly for health systems

- A client roster featuring leading employers known for quality and innovation in health benefits delivery

- Strategic analysis, design, and integration with existing health management programs

- Flexible, objective benefit design for greater control in payment models, data integration, and network coverage

- Comprehensive reporting tools and protection of confidential information

- Exceptional client relationships, with a proven track record reflected by exceptional client retention and consistently high Net Promoter scores

- Experienced, responsive, and friendly service from a professional, caring, and hardworking team that delivers unparalleled support

-

Close examination of the additional value

-

Combination of offerings and continuous innovation

-

Legacy and leadership backed by strength and resources

Not already self-funded? For health systems that are not already self-funded, Contigo Health can lead the transition when they are ready to make the change.

Ready to learn more? Speak with a Contigo Health Representative today at 330-656-1072 or visit contigohealth.com.

1. Berchick, Edward R., Hood, Emily, and Barnett, Jessica. 2018. “Health Insurance Coverage in the United States: 2017.” United States Census Bureau. September 12, 2018. https://www.census.gov/library/publications/2018/demo/p60-264.html

2. Business Group on Health. 2020. “2021 Large Employers’ Health Care Strategy and Plan Design Survey.” August 2020. https://www.businessgrouphealth.org/resources/2021-large-employers-health-care-strategy-and-plan-design-survey

3. Kaiser Family Foundation (KFF). 2019. “2019 Employer Health Benefits Survey.” September 25, 2019. https://www.kff.org/health-costs/report/2019-employer-health-benefits-survey/

4. KFF Survey. 2019. https://www.kff.org/health-costs/report/2019-employer-health-benefits-survey/

5. Health Care Cost Institute (HCCI). 2019. “2017 Health Care Cost and Utilization Report.” February 11, 2019. https://healthcostinstitute.org/annual-reports/2017-health-care-cost-and-utilization-report

6. Spitzler, Julie. 2018. “Health IT spending last year prioritized EMRs.” Becker’s Health IT. January 29, 2018. https://www.beckershospitalreview.com/healthcare-information-technology/health-it-spending-last-year-prioritized-emrs.html

7. Business Group on Health Survey. 2020 https://www.businessgrouphealth.org/resources/2021-large-employers-health-care-strategy-and-plan-design-survey

8. America’s Health Insurance Plan. 2018. “The Value of Employer-Provided Coverage.” February 2018. https://www.ahip.org/wp-content/uploads/2018/02/AHIP_LGP_ValueOfESIResearch_Print_2.5.18.pdf

9. Deloitte Development LLC. 2013, “Talent 2020: Surveying the talent paradox from the employee perspective – The view from the Health Care sector.” September 2012. https://www2.deloitte.com/us/en/pages/human-capital/articles/talent-2020-paradox-health-care-sector.html

Disclaimer: Forward-looking statements are predictive in nature and reflect the authors’ beliefs at the time of the statement. Embedded links are accurate at the time of publication and are subject to change. Reasonable efforts have been made to ensure that the information contained herein is accurate and from reliable sources. Contigo Health, LLC, is not responsible for any errors or omissions, or for the results obtained from the use of this information.

© 2024. Contigo Health, LLC. All rights reserved.

Substance use disorder (SUD) is something that touches us all. Whether it’s due to the lasting effects of the pandemic or the pressures applied on modern society both economically and emotionally, SUD is on the rise. Especially in the workplace. In fact, 70% of people suffering from SUD are employed, and studies suggest that there has been a 30% increase in substance use overall since 2020.¹ These numbers are eye opening and should make us think about the true cost of SUD.

SUD is costing employers and the workplace.

The modern work environment is changing and evolving quickly, and the pressures on employees have never been greater. Hence the rise in substance use, which in the end costs employers. The annual cost of a SUD diagnosis in 2018 for employers who self-insure was $15,640 per affected health plan member and $35.3 billion in the U.S. population.² Overall, lost productivity from SUD costs employers $25.5 billion a year, and workers with untreated SUD miss nearly 50% more days a year than their peers.³ Absenteeism from substance use isn’t simply inconvenient; it creates serious productivity issues as well.

Jobs are either not being done or are not being done correctly, and employees under the influence in the workplace are a danger not only to themselves but to others. This is especially true in industries like manufacturing and transportation, where lives could be on the line. All of this may lead to employers incurring costs such as hiring replacement workers or adding to others’ workloads, which makes for low morale and a less-than-optimum company culture. But the real loss is to the affected employee. Without treatment, they will struggle to reach their full potential both in the work environment and life.

According to Quit Genius, turnover is another significant issue facing employers as a direct result of SUD.⁴ Twenty-five percent of employees report having had more than one employer in the past year. That number rises dramatically to 36% among employees with SUD. Productivity suffers when people change jobs frequently and onboarding has to happen. Replacing employees is also expensive. From recruitment to training new employees, the cost burden for the employer is approximately 21% of a job’s annual salary. No matter how you dissect the cost of SUD in the workplace, you’ll see it’s a problem that employers need to notice and address.

SUD is costing us all.

While we are able to quantify what SUD costs employers and the workplace to operate, the societal costs are immeasurable. From diseases, hypertension, mental health issues, and premature death to the cost of interdiction, law enforcement, prosecution, and incarceration, society pays dearly for SUD. Consumers pay in the form of higher prices for goods and services.⁵ Employers and employees pay higher health insurance premiums, and we all pay higher taxes for healthcare, law enforcement, and treatment programs.⁶

But it’s the personal costs that are the hardest to measure and heaviest to bear. Poor health, broken relationships, and financial hardships are but a few of the tolls that SUD takes. When someone has a family member suffering from SUD, it can impact their own ability to focus at work and may cause financial hardship, reduce their own job retention, and increase anxiety and depression.

Children are also adversely affected by this affliction. Many people don’t realize that exposure to SUD and adverse

childhood experiences is associated with increased risk for health problems across a lifespan.⁷ The ripple effect of SUD throughout society is unmistakable and costly. But we must remember that SUD isn’t the result of an individual’s moral failing but is rather a chronic condition that needs to be treated.

Lost productivity from SUD

costs employers $25.5 billion per year.

Workers with untreated SUD miss nearly 50% more days a year than their peers.

Contigo Health offers a revolutionary new approach to treating SUD.

The costs of SUD both financially and emotionally are alarming—so alarming that they inspired us to react with a revolutionary new approach to treating it. Our program is designed to be everything traditional care isn’t. It’s discreet, allowing employees to work without having to share personal struggles with their employer in industries that don’t have mandatory drug screening. It allows a person to continue on with their life while seeking treatment. And it’s accepting, welcoming all with open arms, with special consideration for members of the LGBTQ+ community and diverse populations.

What makes our SUD treatment program so unique?

We offer immediate support, 24/7. After an initial triage call and determination is made about the right level of treatment, health plan members are referred to licensed counselors for a detailed assessment. Then the health plan member will begin receiving treatment from one of our trusted partners. For outpatient care there’s Lionrock Behavioral Health, Inc., who pioneered virtual outpatient SUD treatment and continues to lead the way in virtual care with great success. If in-person treatment is needed, we offer access to our world-class partner Hazelden Betty Ford Foundation. Everyone has a different need. What makes our SUD program so unique, aside from its superior support, is that a health plan member can access the full spectrum of care within one program and within multiple modalities.

Now virtual care from home can happen, which removes the barrier of access and allows for far less life disruption. One-on-one sessions, support groups, and group sessions can all be handled outside of work with virtual treatments, so the person doesn’t have to leave their family or job. No matter the treatment, our program wraps its arms around the individual and gives them high-quality care and social support, surrounding them with a success-driven team that’s with them all the way.

This team of professionals will help continue treatment for however long it’s needed to achieve success and maintain recovery. This revolutionary way of treating plan members is a part of our Centers of Excellence transformation. We call it Contigo Health Centers of Excellence 360™, a first-of-its-kind, guided comprehensive care journey. It’s the next phase in making plan member care more accessible and effective.

The cost of SUD in the workplace is something that forward-thinking employers know they must address with new and innovative treatment options. To that end, the number of employers offering Centers of Excellence for SUD leapt from 20% in 2022 to 34% in 2023, and another 19% might implement it in 2024.⁸ But while SUD’s impact on the workplace is measurable in dollars and cents, it’s the impact SUD has on the lives of employees and dependents that makes up the real cost. And it’s this real cost, this immeasurable cost, that drives us to find and offer more revolutionary treatment to help get people back to living their best, most productive lives possible.

Employers offering SUD treatment leapt 20% in 2022

to 34% in 2023 and another 19% might implement in 2024.

1. Frank Diamond. 2023. “Substance Use Disorders Cost Employer-Sponsored Health Insurance Over $35B A Year: CDC Study.” Fierce Healthcare. https://www.fiercehealthcare.com/payers/substance-use-disorders-cost-employer-sponsored-health-insurance-over-35-billion-year-cdc (accessed 04/16/2023).

2. Li, Mengyao, Cora Peterson, Likang Xu, et al. 2023. “Medical Costs of Substance Use Disorders in the US Employer-Sponsored Insurance Population.” JAMA Network Open, 6(1).

3. Quit Genius. 2020. “Understanding the Employer-Facing Cost Burdens of Addiction.”

https://www.quitgenius.com/blog/employer-facing-cost-burdens-of-addiction. (accessed 04/12/2023).

5. Health Policy Institute “Substance Abuse: Facing the Costs” https://hpi.georgetown.edu/abuse/ (accessed 05/15/2023).

6. Health Policy Institute “Substance Abuse: Facing the Costs” https://hpi.georgetown.edu/abuse/ (accessed 05/15/2023).

7. CDC Vitalsigns 2019 “Adverse Childhood Experiences (ACEs) Preventing early trauma to improve adult health” https://www.cdc.gov/vitalsigns/aces/pdf/vs-1105-aces-H.pdf (accessed 04/17/2023).

8. Frank Diamond. 2023. “Substance Use Disorders Cost Employer-Sponsored Health Insurance Over $35B A Year: CDC Study.” Fierce Healthcare. https://www.fiercehealthcare.com/payers/substance-use-disorders-cost-employer-sponsored-health-insurance-over-35-billion-year-cdc. (accessed 04/17/2023).

© 2024. Contigo Health, LLC. All rights reserved.

InsideOut Podcast

June 15, 2023

On this episode of InsideOut, Michael Alkire, Premier, Inc. President and CEO, welcomes co-host Dr. Jonathan Slotkin, Contigo Health’s Chief Medical Officer and guest, Lisa Woods, Vice President, Physical and Emotional Wellbeing of Walmart to discuss their strong commitment to healthcare and the comprehensive and cost-effective benefits in place for their employees.

Source URL: https://premierinc.libsyn.com/walmart-on-the-employers-role-in-healthcare-transformation

© 2024. Contigo Health, LLC. All rights reserved.

A new purpose-built national wrap network could minimize cost, simplify the claims process, and make out-of-network care less painful for employer-funded health plans.

The need to strike a balance between provider access and cost of care is perhaps most profound in an employer’s wrap network.

Introduction

According to a national survey, employers recognize that their health benefits plans are playing a more pronounced role in attracting and retaining employees, especially since the pandemic. Two-thirds of employers consider health benefits as vitally important in their management of talent. But while employers are seeking to expand their health benefits offerings—a broader provider network being one of the most important factors—they are highly concerned about managing the cost of care. The latter point is particularly significant as most employers (60%) have seen their healthcare costs outpace inflation over the past three years and expect that trend to continue.¹

While many health plan provider networks are comprehensive, plan members still venture beyond the reach of their primary network. Whether they are traveling or close to home, employees and their dependents sometimes choose to engage providers that are not within their plan’s established network. That’s when a wrap network comes in.

Wrap networks are designed to enable access to care when plan members do opt to seek care from a specialist that is not in the health plan’s primary network. The challenge for employers is that with little or no provider fee boundaries nor sufficient pricing transparency, out-of-network care is often financially distressing to health plans and the employees and families they serve. While employers are willing to give their health plan members the choice to seek care out of network, there is also a need to establish greater cost control for that care. Unfortunately, HR decision makers tend to have little familiarity with and understanding of wrap networks.

The employers who are familiar tend to be satisfied with the breadth and quality of their wrap network but are often extremely dissatisfied with the associated expenditure. These employers consider the most important attributes of a viable wrap network solution to be controlling the cost of access to providers, pricing transparency, and cost savings greater than currently available options.

“The intent is to be able to bring more transparent network products to the market—especially in areas where transparency has been lacking, such as with out-of-network care. We are rethinking out-of-network wrap products to align them with what employers tell us they value most—cost savings and transparent pricing.”

Robin Bugni,

Contigo Health’s VP of Network Product & Development

Considering the lack of awareness and understanding of wrap networks and the level of dissatisfaction with the cost of out-of-network care, there is a significant opportunity for a better wrap network solution, one that delivers valued network breadth while also directly lowering medical claims costs through defined discounts and pricing transparency—in other words, building a wrap network that delivers on what matters most to employer-funded health plans. There is substantial employer interest in ConfigureNet™, a compelling wrap network model from Contigo Health® intended to address the access-versus-cost challenge by extending comprehensive coverage in all 50 U.S. states and across specialties while simultaneously introducing a level of cost savings through pre-negotiated provider pricing and a streamlined process that is direct to employers.

The high cost of out-of-network care

Out-of-network care has traditionally been more costly to a health plan and its members than in-network care. Out-of-network providers have had the freedom to charge higher rates since they are not bound by the health plan’s contracted primary provider network reimbursement. Out-of-network providers have no obligation to accept the reimbursement amount the health plan is willing to pay its in-network providers. This commonly leads to the practice of balance billing, where the provider charges the patient an amount above what the health plan paid and up to the provider’s originally billed amount. This can be an unpleasant surprise to health plan members and the health plan itself.

Beyond the provider reimbursement difference, the medical claims repricing progression often involves multiple intermediaries providing various services for which each can take its own administrative fee, adding more unexpected administrative cost to the health plan.

Contigo Health, LLC, as an architect of financially sustainable healthcare, has taken steps to identify a key area where a more contemporary model with real cost controls and pricing transparency could help employers address the care and cost imbalance of out-of-network care.

A survey about wrap networks

To gain a better understanding of current perceptions about wrap networks, and to reveal what gaps and opportunities there may be to improve those networks, a study was conducted by Stonegate in April of 2022.²

The survey focused primarily on input from health system employers—specifically HR decision makers and health system executives. This audience represents leadership in healthcare delivery, intimate knowledge of healthcare infrastructure and pricing, and perspective as one of the largest employers in a market. The findings complement broader industry studies regarding employer perceptions of care versus cost. The results revealed four distinct areas of interest for anyone desiring to create a better wrap network solution for their health plan.

How familiar are you with the word “wrap network”?*

*Sample size is 25.

Familiar (familiar) – 60%

Very Unfamiliar (somewhat to very) – 28%

Very Familiar (somewhat to very) – 12%

Nearly half (46%) of HR decision makers indicated they are neutral to extremely dissatisfied with the cost of their wrap network access.

Four things that employers should know about wrap networks

1. Health plan decision makers don’t tend to understand wrap networks.

An interesting discovery from the Stonegate study is that employers, by and large, do not appear to have a strong awareness of wrap networks, let alone an understanding of the costs associated with such networks. Among the HR decision makers surveyed:

- Nearly 1 in 3 (28%) are very unfamiliar with the term “wrap network.”

- Most (57%) admitted they don’t understand the costs associated with their current wrap network. Just 43% said that they definitely understand the costs.

This gap in understanding is an opportunity for a new wrap network solution that can deliver needed clarity, consistency, simplicity, and support. For those that do have an understanding of their wrap networks, the study revealed some valuable insight into what matters most to them, as is revealed in the next sections.

2. Breadth and quality get high marks. Cost, not so much.

The Stonegate-conducted study asked employers to identify the best and worst attributes of their current wrap network. The survey revealed that health plan decision makers are largely satisfied with their current wrap networks when it comes to the breadth and quality of network access.

- 85% are extremely satisfied with the extent of their wrap network

- 85% are extremely satisfied with the quality of network access

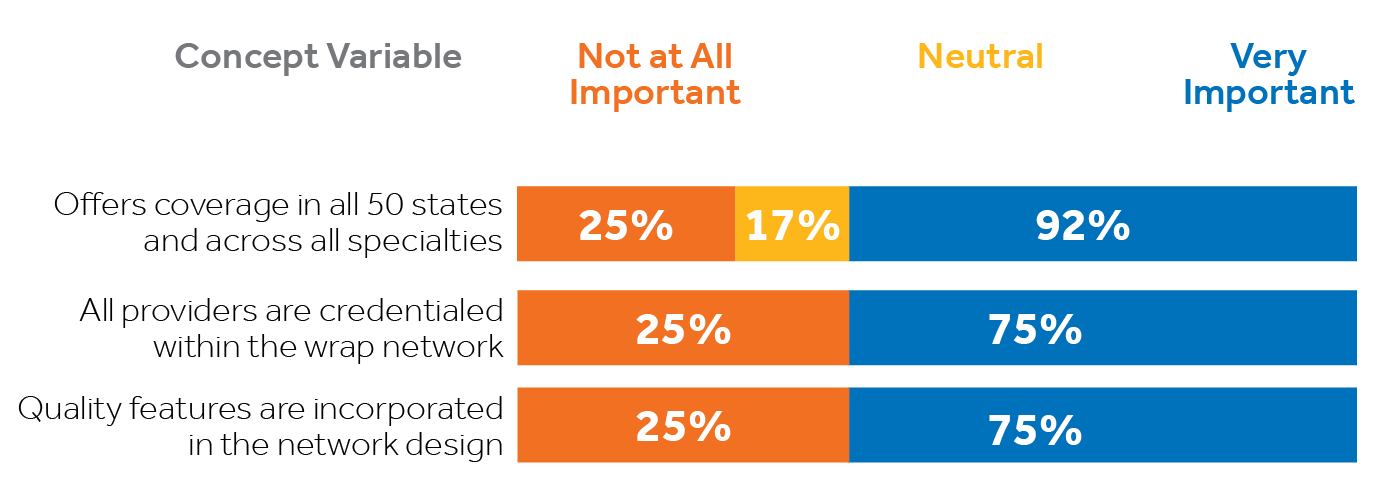

HR decision makers identified the following as the most important wrap network access and quality attributes.

Importance of access and quality attributes to HR decision makers

As encouraging as that is, employers are clearly less than satisfied and more concerned with the cost of that access. In fact, cost is the highest area of dissatisfaction among health system employers surveyed specific to wrap networks. Nearly half (46%) of HR decision makers indicated they are neutral to extremely dissatisfied with the cost of their wrap network access. That percentage may be conservative considering, in section 1, it was revealed that 57% of HR decision makers surveyed do not even understand the costs associated with their wrap networks.

3. It comes down to economics.

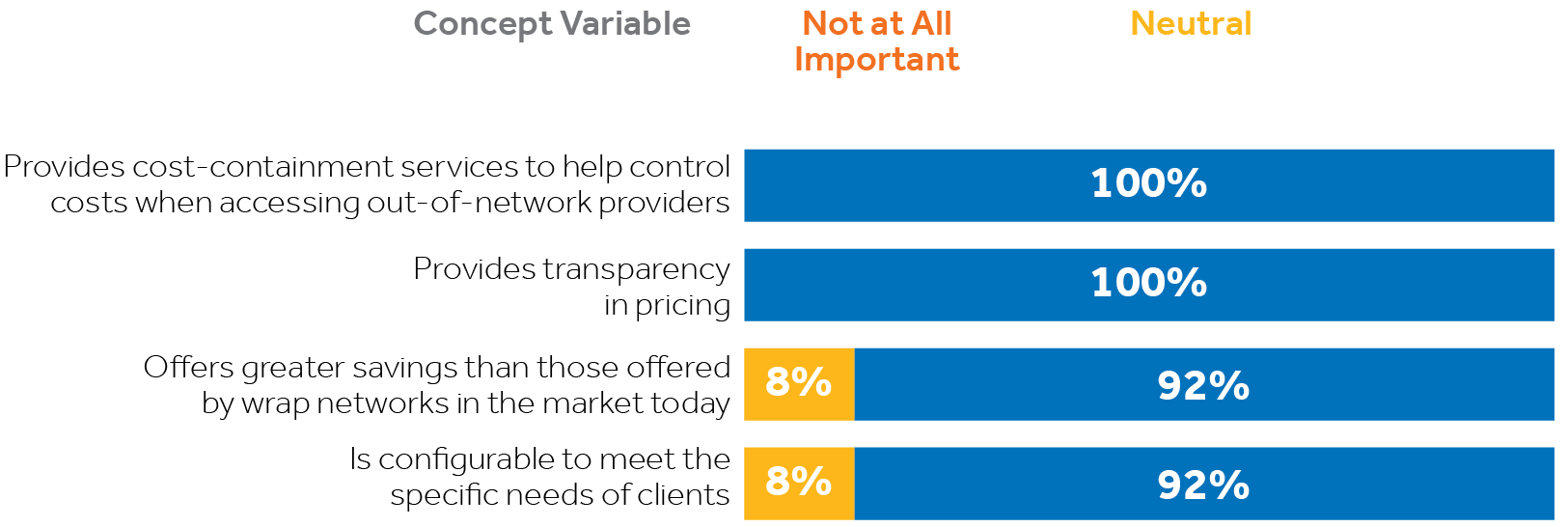

The aspects of a wrap network that rose to the top among health plan decision makers surveyed by Stonegate consistently involved three areas: cost containment, pricing transparency, and cost savings. These are the characteristics identified as VERY IMPORTANT to employers:

- 100% indicated cost-containment when accessing out-of-network providers

- 100% emphasized pricing transparency

- 92% want more savings than what’s currently available

- 92% want a configurable wrap solution that meets their specific needs

Importance of economic wrap network attributes to HR decision makers

In consideration of the first three core study findings listed above, it is evident there is call for a more suitable wrap network solution for employers than is currently available. A better wrap network product would directly address employers’ cost concerns without compromising their plan’s access to care. The optimal solution would deliver on all the things that matter most to employers, including breadth and depth of their wrap network access, plus significant cost savings beyond the industry status quo, along with much-needed pricing transparency—in other words, securing the lowest possible price and eliminating unexpected charges without compromising access to care.

“Contigo Health’s charge is to be the architect of better, more sustainable healthcare. We are building the foundation for future network structures from the ground up by helping to reduce the cost of out-of-network care, should people need it.”

Steven Nelson, President,

Contigo Health

4. One solution is showing great promise.

There is significant interest among health system HR decision makers and executives in a new wrap network product pioneered by Contigo Health. Known as Contigo Health® ConfigureNet™, this contemporary wrap network product is structured to provide the coast-to-coast national coverage and key specialties that employers value highly. The wrap is differentiated in that it has been designed to introduce significantly discounted provider rates and a high level of pricing transparency, combining to enable a level of cost savings greater than what is currently available in the market. As the name suggests, ConfigureNet™ is also designed to eventually become configurable to meet the distinct needs of individual employers.

Developed specifically to meet the needs most emphasized by employers, ConfigureNet™ provides health plans with robust out-of-network provider access at a lower cost. The following features directly address those expressed needs:

Broad network coverage spanning all 50 U.S. states plus Puerto Rico

Pre-negotiated contracted discounts with 900,000 U.S. providers and 4.3 million U.S. locations

Better negotiated rates and greater savings

Contractual protection from surprise balance billing

Claims repriced promptly to contracted rate—no additional handling or unwarranted additional fees

ConfigureNet™ introduces nationwide access to contracted healthcare providers with pre-negotiated discounts in place for a full range of provider services including:

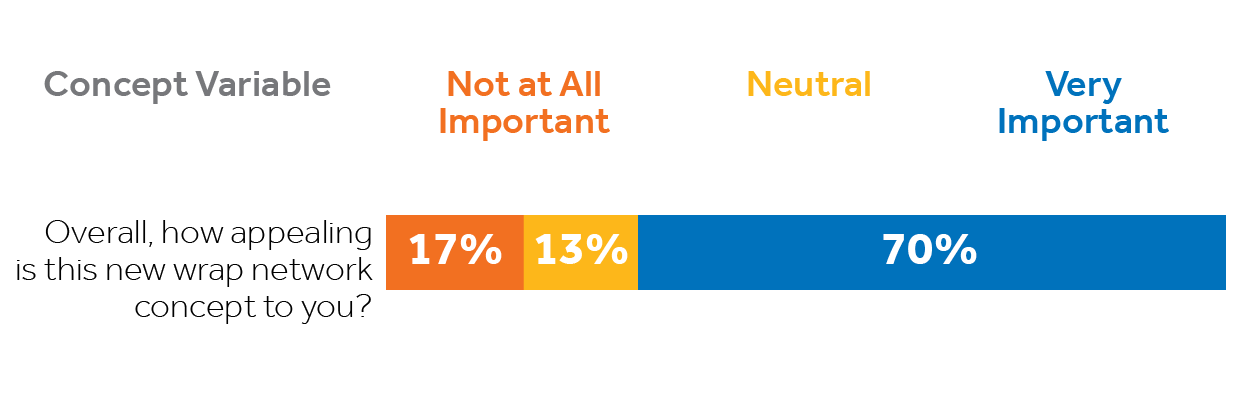

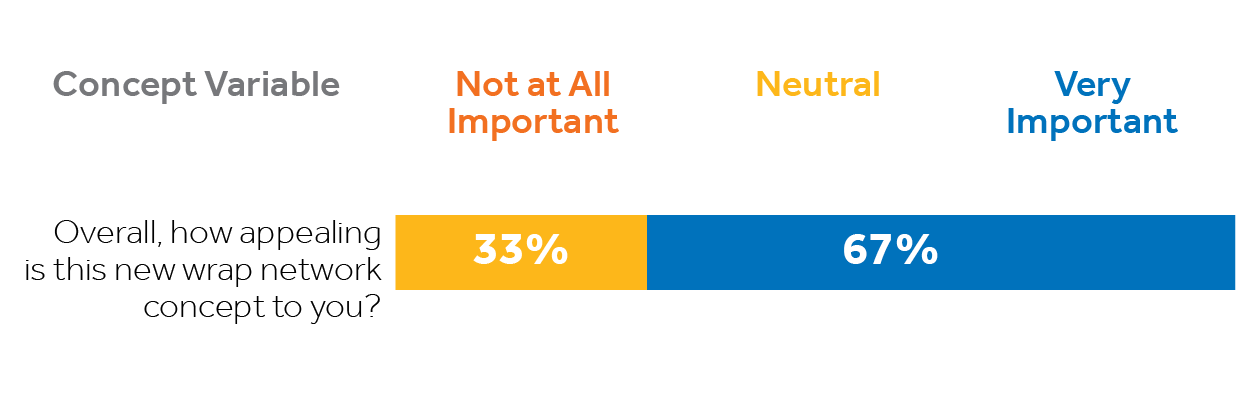

70% of executives and 67% of HR decision makers find the ConfigureNet™ wrap network concept very appealing.

A majority of Stonegate survey respondents find the ConfigureNet™ wrap network concept very appealing.

How executives view the ConfigureNet™ wrap network concept

How HR decision makers view the ConfigureNet™ wrap network concept

Contigo Health’s ConfigureNet™ out-of-network wrap solution has tremendous appeal because it addresses employers’ most pressing wrap network concerns while presenting features that matter most. Fifty percent of surveyed executives would definitely consider switching their wrap network if doing so would provide financial benefits to their organization. A third of HR decision makers and 30% of executives would consider carving out their wrap network from their current plan.

SUMMARY

Health benefits—including expanded out-of-network coverage—are increasingly important to employers as they place greater emphasis on attracting and retaining talent. Even so, they have serious concerns about managing the rising costs associated with those benefits, especially the high cost of out-of-network care.

Unfortunately, many employer-funded health plan decision makers and executives are either unaware of their wrap network or do not understand it. But compelling gaps in current wrap networks have been revealed in recent data, indicating there are attractive opportunities to provide employers with a better, more viable out-of-network solution that addresses the distinct attributes and performance characteristics decision makers have indicated are most important to them.

Employers who have a more thorough understanding of wrap networks appreciate the breadth of their current plans’ access to out-of-network care but, at the same time, are frustrated by the associated costs and lack of transparency. They would welcome a solution that substantially cuts their out-of-network costs without compromising valued access to care. Contigo Health’s new ConfigureNet™ wrap network appeals broadly because it is designed to give health plan decision makers more control of their wrap network. ConfigureNet™ preserves the merits of a broad and robust provider network (what employers like) while substantially controlling costs (what employers want). This is accomplished through contracts with 900,000 U.S. providers and more than four million locations coast-to-coast, and introduces pre-negotiated discounts, pricing transparency, and a streamlined process that can cut unwarranted additional fees. It can empower health plan administrators to impact their organization’s bottom lines while enhancing access and choice for their health plan members.

What solution will you bring to your health plan?

ConfigureNet™ has tremendous appeal to employers because it addresses their most significant wrap network concerns directly and delivers the attributes that matter most. Fifty percent of executives surveyed would “definitely consider switching” their wrap network if doing so would have financial benefits for their organization. That is why 37% of executives expressed they would be very interested in a no-cost consultation to compare the costs of ConfigureNet™ to their existing wrap network.

Leveraging its ConfigureNet™ nationwide provider network, Contigo Health has also created ConfigureNet™ Price Advantage, a flexible plug-in that gives employers a smart, “on-demand” repricing solution when and where it is needed most. It can be implemented as their dedicated

out-of-network cost-containment solution, or configured as a cost-saving option to expand the power of out-of-network cost containment solutions that may already be in place. Price Advantage was designed to be a no-risk, no obligation alternative.

See how Contigo Health can help you establish clear savings on your out-of-network wrap by conducting a complimentary out-of-network wrap cost analysis for each.

How it works:

1. You share health plan claims data

2. Contigo Health analyzes the health plan’s existing out-of-network claims data for the past year and identifies savings potential (two-week turnaround)

3. We meet to review and discuss savings opportunity and quote

4. Contigo Health creates a contract to make an easy and frictionless switch

For more information, contact Britt Hayes, Contigo Health’s Chief Commercial Officer at Britt.Hayes@contigohealth.com, or call 330-656-1072.

1. Aditya Gupta, Nikhil Mahajan, Carolina Malcher, Monica Qian, Matthew Scally, and Jeris Stueland, “Employers Look to Expand Health Benefits While Managing Medical Costs,” McKinsey & Company Employer Health Benefits Survey (May 25, 2022) source

2. ConfigureNetTM and Beckers, Health Plan Wrap Networks Perceptions survey (conducted by Stonegate), April 2022

© 2024. Contigo Health, LLC. All rights reserved.

MobiHealthNews

April 20, 2023

At HIMSS23, panelists discussed health systems’ financial challenges as labor costs rise and the population ages.

By Emily Olsen

Health systems are facing a difficult financial future as labor costs soar and the population ages, increasing demand just as hospitals have less resources to serve them, said panelists at the 2023 HIMSS Global Health Conference & Exhibition.

Kaveh Safavi, senior managing director of healthcare at Accenture, is concerned access is going to become a much bigger issue. Though he’s hopeful that technology like generative AI could ease some of the documentation and administrative burden on providers, that future might not come soon enough.

“I actually think that tech is going to give us an answer. I’m not sure we’re going to be able to take advantage of it as quickly as we need to,” he said.

Cris Ross, chief information officer at the Mayo Clinic, said he thinks technology like ChatGPT will gain traction, but he’s not ready to unleash it yet. For one, the technology sometimes confidently spouts false information.

And he argues many health systems simply won’t be able to take advantage of the technology at all.

“I think for many, many health systems for whom their IT department is the phone call to their EHR vendor, they don’t have the wherewithal to invest in sophisticated technologies,” he said. “And it’s going to have to be the hyperscale companies that can assist them because they can do things at scale.”

Larry Leisure, founder and managing director of Chicago Pacific Founders, said the increasing cost of healthcare may soon come to a head. Employers simply can’t push costs onto their employees any more.

“For a whole swath of lower and middle income workers, they can’t afford deductibles and coinsurance,” he said. “And so this notion that we’re going to be able to do some additional cost shifting is highly problematic.”

Steven Nelson, president of Contigo Health, said the industry frequently talks about how patients are acting more like consumers, but many aren’t very engaged, only checking into their benefits at the very last minute.

“I think it’s going to be hard to refresh the consumer and get them to take concern unless they’re chronically ill and it’s that meaningful, unless they have a substance use disorder problem, unless they have a diagnosis or something with their family member,” he said. “I just think it takes something else to get everybody at the table. Even in this conference, are we really, truly engaged in our benefits to reduce that demand? I don’t know if we are.”

But Safavi argues the idea that demand for healthcare can be easily prevented is an “appealing mythology.” Many diseases are driven by genetic and social factors, and the healthcare system will struggle to address some of the nation’s biggest public health concerns, like gun violence.

“These are super complicated. It’s a combination of genetic and environmental factors that happen in certain sequences. Making good life choices may or may not work,” he said. “There are so many things that are going into it, to me it’s just harder and harder to have confidence that if you just live a good life it’s going to be enough.”

Source URL: https://www.mobihealthnews.com/news/tech-may-not-be-easy-solution-health-systems-financial-challenges

© 2024. Contigo Health, LLC. All rights reserved.

As a forerunner in the centers of excellence category, Contigo Health® now brings to market our new substance use disorder program, which surrounds and supports individuals seeking treatment.

For reasons almost too numerous to count, including the most recent pandemic, substance use disorders, or SUDs, have been on a steady rise in the workplace and beyond. Whether it be the lasting effects of the pandemic or the changing family and socioeconomic dynamics facing our communities, we must look at this not as an individual problem but rather as a problem gripping us all.

70.4% of all adults with an alcohol or illicit drug use disorder are employed,1 and 1 in 7 Americans will experience a substance use disorder.² According to one national survey in 2021, Americans’ substance use has increased 30% overall since the start of the pandemic.4

The numbers back this up: 70.4% of all adults with an alcohol or illicit drug use disorder are employed,¹ and 1 in 7 Americans will experience a substance use disorder.² And it’s staggering to think that 10% to 15% of those in healthcare will misuse substances during their lifetime.³

According to one national survey in 2021, Americans’ substance use has increased 30% overall since the start of the pandemic.⁴ These numbers should startle us and make us realize that reframing the conversation around substance use disorder isn’t something we need to do but rather something we have to do.

SUBSTANCE USE DISORDERS AREN’T CONFINED TO A SINGLE BUSINESS VERTICAL.

It’s once again clear that SUD involves us all.

AN EFFECTIVE POLICY ISN’T SOMETHING THAT JUST HAPPENS.

It’s driven by a positive workplace culture that begins and ends with employers making employees comfortable and aware of their particular policy and its positive effects.

Let’s understand how SUDs are affecting the workplace.

According to the National Safety Council, the impact of substance use disorders on the workplace is considerable. Some studies place the base cost for employers to recruit and train replacement workers at a third of a worker’s annual salary, with additional costs to the employer totaling roughly half that salary when all is said and done. In some sectors with higher average salaries, this cost can be even greater.⁵

The costs for employers who have employees with untreated SUDs is also eye-opening. The annual attributable medical expenditure of a SUD diagnosis for employer-sponsored insurance was found to be $15,640 per affected enrollee and a staggering $35.3 billion in the population. Alcohol-related disorders ($10.2 billion) and opioid-related disorders ($7.3 billion) were the most costly.⁶

In addition, almost 9% of working adults have a substance use disorder, with alcohol use and cannabis use disorders being the most common. Rates of SUDs are higher in industries like construction, trucking, and mining. Industries with easy access to alcohol, like entertainment and food service, also have higher SUD rates.⁵

Changing the stigma surrounding SUDs needs to be a goal.

For far too long, society—and especially the workplace—has seen those suffering from substance use disorders as having a moral failing. The perception that this disorder is a choice needs to change. We need to look at substance use disorders not as a personal failure but as a serious health problem on par with other unmanaged chronic conditions like diabetes and COPD. This reality—long understood by SUD treatment professionals but still new to many—has to be driven home by employers. If a drug-free workplace and healthier employees are the goals, success rests firmly in the lap of employers, who must be advocates for their employees, a significant number of whom may be suffering in silence due to fear of losing their jobs.

After all, an effective policy isn’t something that just happens—it’s driven by a positive workplace culture that begins and ends with employers making employees comfortable and aware of their particular policy and its positive effects.

The bottom line is that employers need a way to offer access to confidential treatment that gives employees the privacy to seek the care they need without fear of losing their jobs or wages.

Changing the conversation around SUDs in the workplace is something we take very seriously at Contigo Health, and it’s why we are pioneering and building a treatment program that’s everything traditional programs have failed to be.

Together, we can all create a more accepting workplace environment.

We can all encourage each other while in the workplace to be strong advocates for our fellow employees who may need support. Seeing those who are struggling as people first—people with a treatable illness—is a step toward helping them on their road to recovery. Regardless, the emphasis should never be on judging a person or looking down on them from a moral high ground but rather on helping them seek the treatment best suited for their success.

The bottom line is that employers need a way to offer access to confidential treatment that gives employees the privacy to seek the care they need without fear of losing their jobs or wages.

At Contigo Health®, we’re helping to change the conversation around SUDs by offering a revolutionary new approach to treating them.

Changing the conversation around SUDs in the workplace is something we take very seriously at Contigo Health, and it’s why we are pioneering and building a treatment program that’s everything traditional programs have failed to be. For one, it’s discreet, allowing employees to work without having to share personal struggles with their employer in industries that don’t have mandatory drug screening, possibly motivating individuals who may not have reached out for help before.

It’s practical, allowing a person to seek care while continuing to work and live at home. And above all, it’s accepting. Our program welcomes all with open arms and gives special consideration to members of the LGBTQIA+ community and diverse populations.

So how does it work?

Immediate support is provided 24/7 from our trusted partner, Lionrock Behavioral Health, Inc., who pioneered virtual outpatient SUD treatment and continues to lead the way in virtual, in-home care. A health plan member will be referred to a licensed counselor to determine the right level of treatment.

What makes our SUD program so unique, aside from the promise of incredible support within an hour, is that our health plan members can access our revolutionary hybrid treatment plan and get residential inpatient care, outpatient care, or virtual outpatient care, depending on their individual needs. Now a person can participate in treatment virtually from home, which removes one of the biggest barriers to treatment: access. Virtual one-on-one meetings and group sessions can all be handled outside of work so the person doesn’t have to leave their family or job, causing less disruption in their lives.

Those with more complex needs—e.g., co-occurring mental health concerns, medication management, and/or a higher-severity SUD—can also access treatment through our world-class and renowned collaborator, the Hazelden Betty Ford Foundation.

The impact of substance use disorders is far-reaching.

No one is untouched. But together, we can help change the conversation surrounding them and combat the stigmas and preconceived notions that traditional workplaces and treatment plans have often held.

Regardless of the determined pathway, what this program does differently is wrap its arms around the individual, providing not just high-quality care for a predetermined period of time but surrounding them with a team. This team will help continue treatment for however long is necessary to achieve success and maintain recovery. In other words, a person receiving treatment isn’t left to go it alone once they exit the program. This new approach to SUDs is something that hasn’t traditionally been offered by many carriers, which has often left employers with a hole in their healthcare plan and employees with untreated SUDs left wondering.

This new way of treating members is a part of our transformation of Contigo Health Centers of Excellence 360™. We’re creating a first-of-its-kind, guided comprehensive care journey. This program is the next phase in making patient care even better. The impact of substance use disorders is far-reaching. No one is untouched. But together, we can help change the conversation surrounding SUDs and combat the stigmas and preconceived notions that traditional workplaces and treatment plans have often held. Because it’s time—time we wrap our arms around those who are suffering and give them the dignity and respect that a person ailing from a true health condition deserves.

For more information, contact Britt Hayes, Contigo Health’s Chief Commercial Officer, at Britt.Hayes@contigohealth.com, or call 330-656-1072.

1. Frone, M. R., L. C. Chosewood, J. C. Osborne, et al. 2022. “Workplace Supported Recovery from Substance Use Disorders: Defining the Construct, Developing a Model, and Proposing an Agenda for Future Research.” Occupational Health Science 6: 475–511. https://doi.org/10.1007/s41542-022-00123-x.

2. Centers for Disease Control and Prevention. 2022. “Stigma Reduction.” https://www.cdc.gov/stopoverdose/stigma/index.html.

3. Butler Center for Research. June 1, 2015. “Health Care Professionals: Addiction and Treatment.” https://www.hazeldenbettyford.org/research-studies/addiction-research/health-care-professionals-substance-abuse#.

4. Hazelden Betty Ford Foundation. 2021. “Americans Increasing Substance Use to Cope with Mental Strain; Parents at Highest Risk.” https://www.hazeldenbettyford.org/press-release/mental-health-index-report.

5. National Safety Council. Accessed January 12, 2023. “Implications of Drug Use for Employers.” https://www.nsc.org/work-safety/safety-topics/drugs-at-work/substances.

6. Li, M., Peterson, C., Xu, L., Mikosz, C. A., & Luo, F. “Medical costs of substance use disorders in the US employer-sponsored insurance population.” JAMA Network Open, 6(1). January 24, 2023. https://doi.org/10.1001/jamanetworkopen.2022.52378

© 2024. Contigo Health, LLC. All rights reserved.

Empowered Patient Podcast

May 30th, 2023

Heather Ridenoure, Center of Excellence Segment Leader, and Maeve Ruggieri, the Director of Product at Contigo Health, shine a light on the challenge of employee substance use disorder and the resources available for care. This chronic disease can be caused by adverse childhood events, genetic predisposition, stress, and environmental factors. Contigo addresses any substance that can be abused through their Centers for Excellence program with virtual care and in-person care options where participation is voluntary and can be accessed 24/7.

Heather explains, “As far as how frequently this occurs, the newest statistics from the Centers for Disease Control said one in seven people have a substance use disorder. That’s new data, and that’s been increasing by 30% since the pandemic, which is pretty significant. So, this is one of the reasons we struck out on a journey to try to address some of these issues.”

Maeve elaborates, “As Heather mentioned, substance use disorder being a chronic disease, is something that causes clinically significant impairment. So that may or may not be visible to an employer in the workplace. Their employees may seem like they are high performers or be high performers and not be showing the stereotypical signs of substance use disorder, things that we may see from TV or movies, like erratic behavior, things even down to missing deadlines.”

“But what’s so important is having the member be ready to participate themselves. This program is rooted in shared decision-making between the member and the providers, and our team at Contigo, who’s doing a lot of care and case management and support. And if the member is not ready to participate, to explore recovery and manage their substance use disorder, then it’s not time yet.”

© 2024. Contigo Health, LLC. All rights reserved.

As health systems look to provide high-quality benefits for their employees, the last thing they need are unexpected claim costs for out-of-network care. Rising costs, compounded with numerous fees charged by intermediaries, can create an unanticipated cost shock for self-funded health systems and their health plan members. Fortunately, the right out-of-network solution can significantly ease the financial hit and improve the bottom line. To help sort out the evolving landscape of out-of-network care, we invite you to participate in an informative webinar designed specifically for health systems. Our panel of top experts will be covering the following:

- How health systems can benefit from an out-of-network wrap solution for their employee health plan and offer as a value add to their provider-sponsored health plan clients.

- How to reap the potential savings on out-of-network utilization.

- The advantages of a national network of pre-contracted providers in all 50 states plus Puerto Rico.

- Simple-switch options designed to not disrupt current benefits from out-of-network providers.

*Courtesy of Validation Institute.

© 2024. Contigo Health, LLC. All rights reserved.

Employee Benefit News

Partner Insights by Contigo Health

Dr. Jonathan Slotkin, Chief Medical Officer

The impact of substance use disorder (SUD) in the U.S. is far-reaching, yet remains misunderstood and untreated and undertreated. Dr. Jonathan Slotkin, Chief Medical Officer, Contigo Health®, shares how employers can change the conversation about SUD and give those employees who are suffering the dignity they deserve and the tools for successful, long-term recovery.

Q. Are there misconceptions about SUD that you’d like to address?

We strongly believe that mental health is health. SUD is a health problem on par with other chronic conditions such as diabetes, cancer, or heart disease. It’s not a moral failing. It’s not a choice. And it’s not an individual problem but a human health problem that grips us all. It impacts entire families, social groups, communities, and workplaces. Seventy percent of adults with a substance use disorder are employed, and one in seven Americans will experience SUD in their lifetime. Many people appear to be functional while still suffering from significant substance use disorder that’s harmful to the patient, their families, and their workplaces.

Q. What can employers do to eliminate the stigma around SUD?

First, employers must embrace the view that SUD is not a personal failing but a chronic health condition and then work to normalize the discussion about SUD. If a drug-free workplace with healthier, more productive employees is the goal, then employers must become advocates and share information about their employer-sponsored SUD health plan benefits and the positive effects of treatment.

How you engage with employees on health issues matters. A positive workplace culture helps make employees feel comfortable that they can maintain their privacy, get real help in a nonjudgmental way, and feel confident that employers will never take punitive action if they access these benefits.

Q. How is Contigo Health’s treatment program different than traditional programs?

Designed in partnership with the world-renowned Hazelden Betty Ford Foundation and Lionrock Recovery, our treatment approach combines virtual outpatient, traditional outpatient, and residential care to give employees options that allow them to seek care while continuing to work and live with their families.

Help is a phone call away 24 hours a day, 7 days a week. Health plan members self-refer into the program. Confidentiality is assured, and Contigo Health prides itself on creating a welcoming, diverse, and inclusive environment for patients. Since many employees with SUD also have additional mental or physical health conditions, our integrated team takes a comprehensive and individualized approach to employees’ overall health.

Q. How does the program benefit employers?

The annual cost of SUD for employers is about $15,600 per employee with alcohol and drug-related disorders, for a staggering $35 billion across the U.S. While a typical employee misses up to three weeks of work a year due to injury, illness, and reasons other than holidays or vacation, employees with SUD miss two additional weeks due to illness and injury. Employees that have received substance use treatment in the past and have not had a substance use disorder within the last 12 months miss the fewest days of any group at an average of only two weeks annually.

Q. How is Contigo Health’s SUD helping to reimagine healthcare benefits?

There are several ways that Contigo Health differs from traditional approaches that we hope others will emulate. For instance, there’s a lot of excitement about virtual care—and there should be—but it’s sometimes to the exclusion of in-person care. We believe that virtual and in-person delivery options must coexist in an individualized treatment approach.

Many healthcare plans end when the employee finishes the formal inpatient, outpatient, or virtual program. Contigo Health continues its support for 12 months to help employees achieve success and long-term recovery. Employees aren’t abandoned when they exit their acute treatment plan.

Regardless of the path a health plan member chooses, the Contigo Health team of experts wraps their arms around the member to help them get back to their best lives.

For more information, Contact Britt Hayes, Contigo Health’s Chief Commercial

Officer, at Britt.Hayes@contigohealth.com, or call 330-656-1072.

© 2024. Contigo Health, LLC. All rights reserved.

An Interview With Jake Frankel

Authority Magazine

Jan 8, 2023

The COVID-19 Pandemic taught all of us many things. One of the sectors that the pandemic put a spotlight on was the healthcare industry. The pandemic showed the resilience of the US healthcare system, but it also pointed out some important areas in need of improvement.

In our interview series called “In Light Of The Pandemic, Here Are The 5 Things We Need To Do To Improve The US Healthcare System”, we are interviewing doctors, hospital administrators, nursing home administrators, and healthcare leaders who can share lessons they learned from the pandemic about how we need to improve the US Healthcare System.

As a part of this series, I had the pleasure to interview Steven Nelson, president of Contigo Health.

Steven Nelson leads the Contigo Health team as president and was one of the leaders who initiated the strategy behind Contigo Health within Premier. Before joining Premier, Nelson was a leader at Anthem Inc., where he served as vice president of strategy and planning and COO of Anthem’s diversified business group. Prior to joining Anthem, Nelson led strategy, product and marketing at Highmark Blue Cross Blue Shield and helped to build Allegheny Health Network, a provider entity consisting of seven hospitals, 2,000 doctors and various other facilities. Nelson has a deep and personal commitment to giving back to his local community as well as the global community, including leading charity work in Haiti. He holds a bachelor’s degree from the University of Pittsburgh and a master’s degree from Ohio University. He and his family reside outside of Pittsburgh, in Gibsonia, Pennsylvania.

Thank you so much for joining us in this interview series! Before we dive into our interview, our readers would like to get to know you a bit. Can you tell us a bit about your backstory and a bit about what brought you to this specific career path?

After spending seven years in the retail industry, including five years spent at GNC as the chief marketing officer, I entered the health insurance market in 2007 when the CEO of Highmark Blue Cross Blue Shield recruited me to establish consumer and retail marketing for them.

At Highmark Blue Cross Blue Shield, I developed a consumer marketing strategy and executed a business plan that helped shift the company to become a customer-centric leader. At the time, this was at the starting point of healthcare “consumerism.”

I worked mostly in the strategy, marketing, innovation, and product areas as a consumer advocate. This includes working on products that we built for individuals who buy their own insurance and employer-sponsored benefit plans. Additionally, I assisted in rebuilding consumer market touchpoints, including retail stores, e-commerce, and consumer advertising.

Looking back, Highmark Blue Cross Blue Shield was an appealing opportunity due to its existing market presence and high-profile status among the Blue Cross Blue Shield community. Its extensive resources — people, process, technology, and funding — provided substantial support for an effective consumer roadmap.

Can you share the most interesting story that happened to you since you began your career?

After spending 15+ years in the health insurance industry, I was ready for something a little different. I decided to leverage my knowledge from previous experiences to assist in creating a startup to diversify a company that wanted to get into the health insurance industry. The key was to find the right partner that had the required existing assets but needed a business plan to crystalize and address the problem they were trying to solve, as well as a team to execute the plan.

I was approached by an industry expert who was assisting Premier Inc. with a plan to diversify its business into adjacent markets and leverage its existing assets and relationships to do so over the next three-to-five years. As a strong data and analytics business with well over 4,400 health system and hospital relationships in the provider market, Premier made for a good fit to explore opportunities with self-insured employers. To be relevant to the employer market, we needed to leverage Premier’s provider relationships yet honor what employers were trying to solve for in their health benefits. Most of the early focus was spent on unit price and inappropriate care; however, as we dug further, we realized that while inappropriate care and patient experience were critical, the focus needed to be on creating and maintaining productive employees. After working through the pandemic, we quickly realized that our third-party administrator (TPA) service and existing product bundles (Centers of Excellence) were not enough to transform the market, so we set out to find ways to build out the network architecture. Our market research led us to secure a network cost containment organization focused on serving health contracts. These health contracts in a cost containment environment helped Contigo Health, a subsidiary of Premier, become a full-fledged network.

Can you share a story about the funniest mistake you made when you were first starting? Can you tell us what lesson you learned from that?

It’s to remember names. For the first year of my first job, I repeatedly called my boss by the wrong name. I would do it in public, including during business meetings. It was a complicated situation because he went by his middle name, and while funny in the beginning, it started becoming a nuisance. I started doing name recall exercises with professional athletes and actors’ names to help jog my memory. It’s important to remember names because it helps you better engage with people.

Anyways, with my boss it ended with me getting a t-shirt with his name on it that I had to wear at a holiday party. Rest assured I will never forget his name again.

Can you please give us your favorite “Life Lesson Quote”? Can you share how that was relevant to you in your life?

“Life is 10 percent what happens to you and 90 percent how you respond to it.” — Lou Holtz

No matter what the task ahead — including those we take on as spouses, parents, or leaders — we are all going to face challenges. Looking beyond them for the next or best move to make is always better than staying in a negative moment. Even when the moment is positive: reflect and then move on.

When looking at my career path, up until Contigo Health, every role I took was a title and pay-grade regression, so I had to continue working my way back up the ladder. While some may see this as a setback, I knew it was better for my career path because it was always the right role at the right time and built out my qualifications differently. How I chose to approach these moments was important, especially in leadership.

The personal side of this is about setting, managing, and evolving goals. It’s about understanding that your goals are fluid and it’s okay to change how you work toward them. Adapt. Adjust. Overcome.

Are you working on any exciting new projects now? How do you think that will help people?

At Contigo Health, we are always creating new ways for clinicians, health systems, and employers to work together in an effort to optimize employee health benefits. We recently bought a new health network — a group of healthcare systems and providers — with a goal to bring more transparent health products to the market by starting with areas where transparency doesn’t exist at all (out-of-wrap network markets). The federal government and states have been trying to do this for quite some time now, and I’m proud to be a part of Contigo Health’s effort to build this model for future networking structures from the ground up to help reduce the cost of out-of-network care, should people need it.

How would you define an “excellent healthcare provider”?

Patients all have unique needs. Excellent providers focus on providing not only the right care but also personalized engagement appropriate for each patient’s unique situation. There is greater comfort — and more positive outcomes — in working with a provider who possesses a deeper understanding of an individual’s needs and approaches their recommended care plan through this lens rather than following a “one size fits all” approach.

Ok, thank you for that. Let’s now jump to the main focus of our interview. The COVID-19 pandemic has put intense pressure on the American healthcare system. Some healthcare systems were at a complete loss as to how to handle this crisis. Can you share with our readers a few examples of where we’ve seen the U.S. healthcare system struggle? How do you think we can correct these specific issues moving forward?

When it comes to healthcare providers, many are paid based on the volume of care (you see your doctor, your doctor gets paid for that visit or service) rather than quality (keeping you healthy and out of the hospital). There is no benchmark for quality of care in the industry. By designing networks that are more patient-centric and considerate of both providers’ and employers’ needs, we can overcome this. It will end up being a win-win for everyone: patients, providers, and employers.

There should be a standard of quality set forth to begin with, so we are all working from the same playbook. Care will only improve from there. Contigo Health is actively working toward expanding its network five-fold to leverage those quality standards in more markets across the United States as we come out of the pandemic.

Of course the story was not entirely negative. Healthcare professionals were true heroes on the front lines of the crisis. The COVID vaccines are saving millions of lives. Can you share a few ways that our healthcare system really did well? If you can, please share a story or example.

Overall, the pandemic drove increased demand for healthcare. One area that is changing is employer-sponsored healthcare, or the healthcare benefits organizations provide their employees. Since the pandemic, employers and healthcare providers have been able to increasingly collaborate in this area when it comes to understanding employee needs more deeply, ultimately ensuring better, more appropriate healthcare outcomes for employees by providing the right care.

At Contigo Health, through our partnerships with major employers in the U.S., such as Fortune 100 companies, we administer centers of excellence for their employees, or programs within healthcare facilities that provide agreed-upon standards of quality care in advance of that care being received. During the pandemic, patients were delaying their care; however, our contracted centers remained open to deliver care as needed in an isolated way. For example, one of our contracted hospitals isolated their maternity ward to continue patient care during the pandemic while instituting safety protocols.

Here is the primary question of our discussion. As a healthcare leader can you share 5 changes that need to be made to improve the overall US healthcare system? Please share a story or example for each.

Five changes that I believe need to be made to improve the overall U.S. healthcare system include:

- Outcomes tracking and monitoring for patients with similar care needs: This will allow patients to gauge the “what” and “when” of receiving care based on factors that matter, and more importantly, outcomes. It will also allow them to pay for certain levels of care and less if benchmarks or agreements are not met.

- Increased pricing transparency: More cost transparency from providers to patients in the industry will allow this “market” (price of products and goods sold) to truly act like a “market.”

- Increase quality transparency: More transparency in the quality of care will inform the patient of quality care standards and how they are aligned to those standards.

- More purpose-built networks: We must focus on building networks that are centered around employees’ needs. An example of this could be having specialized networks — like a dialysis network — that targets specific healthcare needs and disciplines for those with advanced kidney disease.

- Allow more freedom and flexibility for members to engage their network as needed: This will help to expand consumers to access all services lines needed to live a healthier life. An example of this is behavioral health benefits. In the past, this benefit has been regulated and required approvals to engage in. Today, post-pandemic, behavioral health benefits have grown rapidly to the point that trying to control services has significant limitations.

You are a person of great influence. If you could inspire a movement that would bring the most amount of good to the most amount of people, what would that be? You never know what your idea can trigger. 🙂

I’d love to bring more volunteers to the healthcare industry. There is an abundance of need from food banks to deliveries of supplies to community hospitals. One hospital I work with is doubling its volunteer staff right now, training them to help work alongside clinicians to help meet patient needs. It’s fantastic.

How can our readers further follow your work online?

Readers can follow me on LinkedIn. They can also keep on top of the latest work from Contigo Health on our website and social media pages:

Thank you so much for these insights! This was very inspirational and we wish you continued success in your great work.

© 2024. Contigo Health, LLC. All rights reserved.